I’m going to go on a bit of a rant here.

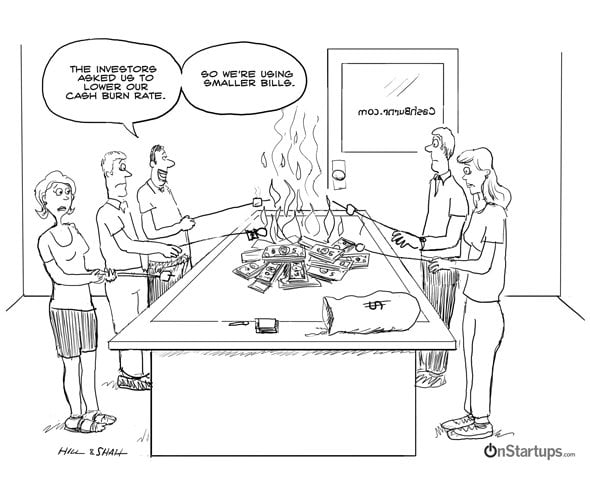

I’m miffed that the industry term for the process whereby startups invest in building their businesses is called “burning cash”. If your startup is burning cash (as shown in the cartoon above), you’re doing it wrong. You should’t be burning money, you should be investing money — with the goal of growing your business.

I find it interesting that when venture capitalists (VCs) take money from their limited partners (LPs), they don’t say: Hey, we’re going to take your money and go burn it on a bunch of different startups. Why? Because that’s not what they do (not the good ones anyways). What they do is invest the cash in the hopes of generating a good return.

So, I’m going to ask that all startups that have raised funding to no longer use the term “burn rate”. Instead, lets call it what it is (or should be): An investment rate. As in "our startup has an investment rate of about $400k/month".

Oh, and if you really are burning cash, please start using smaller bills.